The Impact of Effective Federal Funds Rate Velocity

A publication quantifying interest rate shocks to the economy, coining the term Effective Federal Funds Rate Velocity (EFFRᵥ).

While 2024 and 2007 have their differences, they share more in common than many realize, particularly when it comes to the economic shocks that have often followed significant rate hikes throughout history. I’ve developed a unique tool that will be discussed through this publication to assist in quantifying interest rate shocks to the economy and predicting its implications.

The Landscape Is Always Different, Yet Also Similar

Each U.S. recession shares both unique characteristics and similarities. The landscape behind the U.S. and global economy during a specific time will always be unique to that time. That being said, I believe that one can draw more concrete conclusions on the depth of business cycles by analyzing the patterns of what has consistently happened throughout history, such as a change in interest rates and thus a change in economic activity. Key indicators referenced by the organization that declares U.S. recessions, National Bureau of Economic Research (referred to as “NBER”), provide invaluable, yet extremely overlooked data points to directly uncover the current business cycle, in my opinion (National Bureau of Economic Research 2022).

However, I believe the magnitude of other noise (financial news, short term stock market changes, different opinions and so much more), often hinders one’s ability to more clearly see the significant sensitivity that interest rates have on causing recessions.

Consequently, “this time is different” may just get investors or projectors into trouble.

From my research and brief review of the 2024 Economic Report from the President, it is evident that the Biden Administration has made, and has plans to put in place, considerable efforts and used resources to assist U.S. real estate industry and infrastructure (CEA 2024).

Further, the Biden Administration has been increasing the supply of affordable housing. This comes as a pivotal time as many indicators have shown economic stress and 2024 is an election year.

Coining Effective Federal Funds Rate Velocity (EFFRᵥ)

This publication will break down details to consider around stock market fluctuations, challenges in the commercial real estate market and interest rate changes as they pertain to the sensitivity of the overall system and more specifically, U.S. business cycles (referring to either recessionary or expansionary periods).

The Effective Federal Funds Rate (EFFR) is the interest rate banks charge each other when they lend money overnight. This rate is important because it influences other interest rates, like the ones on loans, mortgages, and savings accounts. It’s set by the Federal Open Market Committee (FOMC).

Effective Federal Funds Rate Velocity (EFFRᵥ), is a term I coined on March 26, 2024. EFFRᵥ is defined as the percentage change in Effective Federal Funds Rate per month. EFFR velocity is used to compare the vector quantity (speed and direction), or velocity, in which the Fed changes interest rates over a given period of time. EFFRᵥ can analyze both increases or decreases in interest rates, but was intended to measure rate hikes initially.

The power of this tool lies in its ability to help predict possible “longer-lasting implications” from interest rate changes on the U.S. economy. It was derived from my in-depth research of the past 8 U.S. recessions. Further, EFFR velocity has also been an important predictive analytics tool which has aided in the development of my unique macroeconomic viewpoint that there is significantly lagging, deep latent economic strain (or the strain) still present as of early 2024. I believe the strain is largely attributable to the EFFR velocity of the 11 interest rate hikes from March 2022 through July 2023.

EFFR velocity was established to be more illustrative of the impact of interest rate shocks (positive or negative) on the U.S. economy during non-recessionary times. As a result, while EFFRᵥ can be calculated for any period of time, it was originally constructed to look at periods of time equal to, or greater than, 5 months and not for incomplete cycles, such as between interest rate changes, or “stop-and-go” monetary policy. As a result, this term may typically be used for retroactive economic analysis but also has predictive ability in specific economic environments, such as where hikes are preceded by stable rates for a given period of time as seen from the later part of 2023 into 2024.

Since the EFFR was not the primary monetary policy tool used to control interest rates until November 3, 1987, EFFRᵥ is best used after that time period as well (Lindsey).

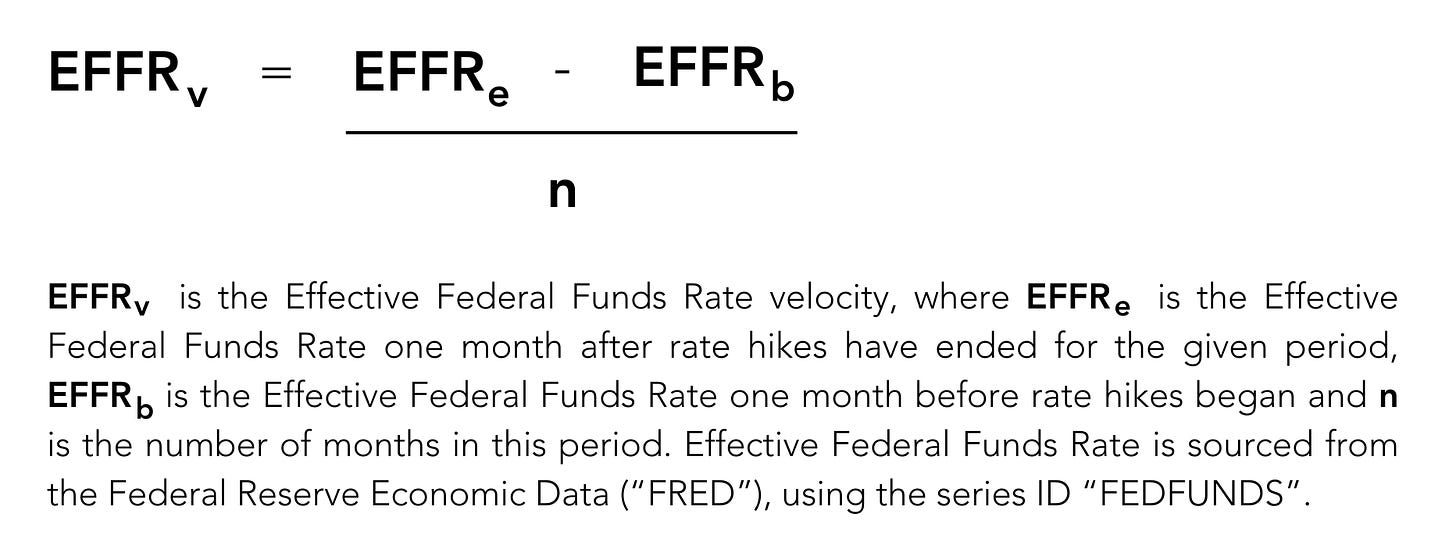

Here’s the formula to calculate the Effective Federal Funds Rate velocity:

You can access the FEDFUNDS series through FRED here.

The formula looks at the EFFR one month before rate hikes started (to account for rising expectations) and one month after rate hikes ended (to account for the lag effect).

Let’s break this formula down further:

For the most recent rate hike period we have the following data from the FOMC, Rate hikes began in March 2022 and ended in July 2023. Therefore, for the calculation of EFFRᵥ during this time period we would use:

EFFRe in August 2023 (one month after rate hikes ended) of 5.33%.

EFFRb in February 2022 (one month before rate hikes began) of 0.08%.

n = 18 months (February 2022 to August 2023).

Now let’s calculate EFFRᵥ:

As you can see from Table 1, EFFRᵥ from the rate hikes in 2022-2023 was nearly 2x that of 2004-2006.

Table 1: 2022-2023 EFFR velocity nearly 2x pace compared to pre-financial crisis

Figure 1: Changes in Effective Federal Funds Rates Around Previous U.S. Recessions, 1967-2024

The EFFR velocity of the 2022-2023 rate hikes has displayed the fastest EFFR velocity increase since 1987. If we look prior to this period, other periods such as 1980-1981 in which the U.S. was still completing a business cycle and battling double digit inflation and 1972-1973 had higher “unofficial EFFRᵥ” but cannot be properly compared as the Federal Funds Rate was not the primary monetary policy tool at the time. This distinction is important because of other tools that also had an impact on the economy during earlier time periods.

Update at the end of May 2024:

The EFFRᵥ of 0.29% per month from 2022-2023 has added considerable strain that is yet to be fully realized as of early 2024.

The FOMC serves a difficult role managing interest rates. The changing of interest rates takes varied amounts of time to for the economy to feel its impact and causes unique ripple effects on the economy based on lagging data and human behaviors that do not always act rationally. Even the best prediction models have had trouble capturing this.

While many are looking for rate cuts in 2024, one may consider whether this could be in response to an impending recession or be a measure taken in a last attempt to “save” the economy. Analyzing past U.S. recessions, one would see this is a consistent historical pattern. Is it already too late for the Fed to prevent a U.S. recession?

Disclaimer

The Visionary Investor does not offer any personal financial advice or advocate the purchase or sale of any securities or investment for any specific individual. We are not financial professionals and make no claims to be. Everything shared by us is for educational purposes only. Investing of any kind involves risk. Past performance does not guarantee future performance. It is imperative that you conduct your own research before making any investments. We will not assume liability of any kind for any losses that may be sustained as a result of applying any methods taught by The Visionary Investor. No investments or other decisions should be made solely based on the contents or information found on this website, any Programs, Workshops or elsewhere by The Visionary Investor. Any opinions shared are our own. Please read our full disclaimer here.

References

Board of Governors of the Federal Reserve System. 2023. “Open Market Operations.” July 26.

CEA (Council of Economic Advisors). 2024. “Economic Report of the President.” Washington U.S. Government Publishing Office.

Federal Reserve Bank of St. Louis. “Federal Reserve Effective Rate [FEDFUNDS]”. FRED.

Lindsey, David E., 2003. “A Modern History of FOMC Communication: 1975-2002.” Federal Open Market Committee. June 24.

National Bureau of Economic Research. 2022. “Business Cycle Dating Procedure: Frequently Asked Questions”. NBER. August 15.

National Bureau of Economic Research. 2023. “US Business Cycle Expansions and Contractions.” NBER. March 14.